life insurance for senior citizens

advertising

The Value of Life Insurance for Senior Citizens

Life insurance is crucial for individuals of all ages, including senior citizens. As we age, our financial obligations and responsibilities continue to grow. Having life insurance in place ensures that our loved ones are protected in the event of our passing, providing economic security and Peace of mind.

Protecting Your Loved Ones

One of the primary reasons senior citizens should consider life insurance is to protect their loved ones financially. Life insurance can help cover funeral expenses, outstanding debts, and provide a source of income for surviving family members.

Ensuring Financial Stability

Life insurance can also help senior citizens ensure financial stability for their spouses, children, or other dependents. It can help replace lost income, pay off mortgages, or cover future expenses such as college tuition or medical bills.

Peace of Mind

Knowing that you have adequate life insurance coverage in place can provide Peace of mind for senior citizens. It eliminates the worry of leaving financial burdens behind and allows you to enjoy your retirement years without the stress of economic insecurity.

Planning for the Future

Life insurance can also be used as a tool for estate planning. Senior citizens can designate beneficiaries and ensure that their assets are distributed according to their wishes. It can also help minimize estate taxes and ensure a smooth transfer of wealth.

Supplementing Retirement Income

Some life insurance policies offer cash value accumulation, which can serve as an additional source of retirement income for senior citizens. It provides an extra layer of financial security and can be used for emergencies or unexpected expenses.

Protecting Business Interests

Senior citizens who own businesses can use life insurance to safeguard their business interests. It can be used to fund buy-sell agreements, protect against the loss of a key employee, or ensure a smooth transition of ownership.

Strengths and Weaknesses of Life Insurance for Senior Citizens

Strengths:

1. Financial Protection: Life insurance provides financial security for loved ones.

2. Estate Planning: It can be used as a tool for estate planning and wealth transfer.

3. Peace of Mind: Knowing that your family is protected can bring Peace of mind.

4. Cash Value Accumulation: Some policies offer cash value accumulation for retirement income.

5. Business Protection: It can safeguard business interests and ensure smooth transitions.

6. Tax Benefits: Life insurance proceeds are often tax-free for beneficiaries.

7. Flexible Coverage: Policies can be tailored to individual needs and budget.

Weaknesses:

1. Cost: Life insurance can be expensive for senior citizens, especially if they have pre-existing health conditions.

2. Limited Options: The availability of life insurance options may be limited for seniors compared to younger individuals.

3. Underwriting Challenges: Seniors may face challenges in underwriting due to age and health factors.

4. Policy Restrictions: Some policies may have restrictions on coverage amounts or specific terms and conditions.

5. Premium Increases: Premiums may increase over time, making it more challenging to afford coverage in later years.

6. Coverage Limits: Some policies have coverage limits or exclusions that may not meet the needs of senior citizens.

7. Policy Lapse: If premiums are not paid, the policy may lapse, leading to loss of coverage.

Complete information about Life Insurance for Senior Citizens

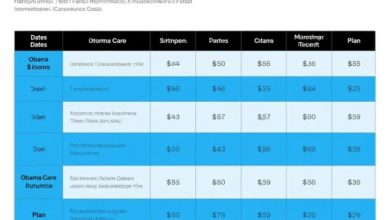

| Policy Type | Coverage Amount | Age Eligibility | Premium Rates |

|---|---|---|---|

| Term Life | $50,000 – $500,000 | 50 – 85 years | Varies based on age and health |

| Whole Life | $10,000 – $100,000 | 50 – 80 years | Fixed premiums |

| Universal Life | $50,000 – $1,000,000 | 50 – 85 years | Flexible premiums |

Frequently Asked Questions about Life Insurance for Senior Citizens

1. What is the best type of life insurance for seniors?

For most seniors, a whole life insurance policy offers the best combination of coverage and affordability.

2. Can seniors with pre-existing conditions get life insurance?

Yes, there are options available for seniors with pre-existing conditions, but premiums may be higher.

3. How much life insurance coverage do seniors need?

The amount of coverage needed depends on individual circumstances, such as outstanding debts, funeral expenses, and future financial obligations.

4. Are life insurance proceeds taxable for beneficiaries?

In most cases, life insurance proceeds are not taxable for beneficiaries, providing a tax-free payout.

5. Can seniors purchase life insurance without a medical exam?

Yes, there are options available for seniors to purchase life insurance without a medical exam, but premiums may be higher.

6. What happens if a senior misses a premium payment?

If a senior misses a premium payment, the policy may lapse, leading to a loss of coverage. Some policies may have a grace period for late payments.

7. Can seniors change beneficiaries on their life insurance policies?

Yes, seniors can typically change beneficiaries on their life insurance policies at any time to reflect changes in their circumstances.

Encouraging Action for Senior Citizens

Life insurance is a valuable tool for senior citizens to ensure financial security and Peace of mind for themselves and their loved ones. By taking the time to explore different options and understand their needs, seniors can make informed decisions about their coverage. It’s never too late to prioritize the financial well-being of your family and protect their future.

Please don’t wait until it’s too late to secure life insurance coverage. You can start exploring your options today and take proactive steps towards protecting your legacy and providing for your loved ones. Your future financial security begins with a solid life insurance plan tailored to your needs.

Please consult with a trusted insurance agent or financial advisor to talk about the best options for your circumstances and get personalized recommendations based on your goals and budget. They can help you navigate the complexities of life insurance and find a policy that meets your unique needs as a senior citizen.

Remember, life insurance is not just about protecting your wealth – it’s about protecting your family’s future and leaving a lasting legacy. Take the first step towards securing your financial legacy by prioritizing life insurance as an essential part of your retirement planning.

Invest in life insurance today to ensure that your loved ones are provided for in the future. Your commitment to financial security and Peace of mind will bring you and your family tremendous comfort and assurance knowing that you have planned for life’s uncertainties. You can start the conversation today and take action to protect your legacy.

Act now and secure the financial future of your loved ones with a comprehensive life insurance plan. By prioritizing your family’s well-being and considering the long-term benefits of life insurance, you can rest assured that you have taken the necessary steps to protect what matters most. Don’t delay – invest in your family’s future today.

Disclaimer

The information I’ve included in this article is for educational and informational purposes only. It is not intended as financial or insurance advice. Before you make any decisions regarding life insurance, please consult with a qualified insurance professional or financial advisor. I just wanted to let you know that this article is not an endorsement of any specific insurance company or product. Individual circumstances may vary, and it is essential to consider your unique needs and goals when choosing life insurance.