humana health insurance alabama

advertising

Introduction

Health insurance is essential for covering medical expenses and ensuring access to quality healthcare services. In Alabama, Humana Health Insurance is a popular choice for individuals and families looking for comprehensive coverage. This article will explore the strengths and weaknesses of Humana Health Insurance in Alabama, providing an in-depth analysis of its offerings and benefits.

Humana Health Insurance Alabama offers a wide range of health insurance plans, including individual, family, and Medicare options. With a strong network of healthcare providers and facilities, Humana ensures that its members have access to high-quality medical care when needed. The company also provides wellness programs and resources to help members maintain their health and well-being.

Despite its many strengths, Humana Health Insurance Alabama does have some weaknesses. These include limitations on coverage for certain services, such as experimental treatments or elective procedures. Additionally, the cost of premiuwms and out-of-pocket expenses can be higher than those of other insurance providers in the state.

Strengths of Humana Health Insurance Alabama

1. Comprehensive Coverage

Humana Health Insurance Alabama offers comprehensive coverage for medical services, including hospital stays, doctor visits, prescription medications, and preventive care. This ensures that members can access the care they need without worrying about high out-of-pocket costs.

2. Network of Providers

Humana has a strong network of healthcare providers and facilities in Alabama, ensuring that members have access to a wide range of medical services. This network includes hospitals, doctors, specialists, and pharmacies, making it easy for members to find the care they need close to home.

3. Wellness Programs

Humana Health Insurance Alabama offers wellness programs and resources to help members stay healthy and active. These programs may include discounts on gym memberships, access to online health tools, and personalized coaching to support healthy lifestyle choices.

4. Affordable Options

Humana Health Insurance Alabama offers a variety of affordable health insurance plans to meet the needs of individuals and families. Whether you are looking for basic coverage or comprehensive benefits, Humana has options to fit your budget and lifestyle.

5. Customer Service

Humana is known for its excellent customer service, with representatives available to assist members with questions, claims, and coverage information. The company also offers online tools and resources to help members manage their health insurance benefits effectively.

6. Medicare Advantage Plans

For seniors in Alabama, Humana offers Medicare Advantage plans that provide comprehensive coverage for medical services, including prescription drug coverage and preventive care. These plans may also include additional benefits, such as vision and dental care, to meet the unique needs of older adults.

7. Financial Stability

Humana Health Insurance Alabama is a financially stable company with a strong reputation for providing reliable coverage and support to its members. This stability ensures that members can trust the company to be there when they need it most, without worrying about changes in coverage or benefits.

Weaknesses of Humana Health Insurance Alabama

1. Limited Coverage Options

While Humana Health Insurance Alabama offers a variety of health insurance plans, some services may not be fully covered under certain plans. This can lead to out-of-pocket expenses for members who require services that are not included in their plan.

2. High Premiums

The cost of premiums for Humana Health Insurance Alabama plans can be higher than those of other insurance providers in the state. This may make it challenging for some individuals and families to afford coverage, especially if they have limited income or resources.

3. Out-of-Pocket Costs

In addition to premiums, members of Humana Health Insurance Alabama may also face high out-of-pocket costs for deductibles, copayments, and coinsurance. These expenses can add up quickly, especially for individuals with chronic health conditions or who require frequent medical care.

4. Limited Provider Network

While Humana has a strong network of providers in Alabama, some members may find that their preferred doctor or specialist is not included in the network. This can lead to challenges in accessing care and may require members to switch providers to receive coverage.

5. Coverage Exclusions

Humana Health Insurance Alabama may have limitations on coverage for certain services, such as experimental treatments or elective procedures. This can be frustrating for members who require these services for their health and well-being, as they may need to seek coverage alternatives or pay out of pocket for care.

6. Complex Plan Options

Some members may find the various plan options offered by Humana Health Insurance Alabama to be confusing or overwhelming. Understanding the differences between plans, coverage levels, and costs can be challenging, especially for individuals who are new to health insurance or have limited experience with navigating healthcare benefits.

7. Customer Service Challenges

While Humana is known for its excellent customer service, some members may experience challenges in getting timely and accurate assistance. Long wait times, difficulty reaching a representative, or lack of follow-up on claims or coverage issues can be frustrating for members who need support with their health insurance benefits.

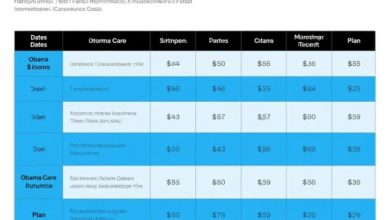

Humana Health Insurance Alabama information

| Plan Options | Individual, Family, Medicare Advantage |

|---|---|

| Coverage | Medical Services, Prescription Medications, Preventive Care |

| Provider Network | Hospitals, Doctors, Specialists, Pharmacies |

| Cost | Premiums, Deductibles, Copayments, Coinsurance |

| Customer Service | 24/7 Support, Online Tools, Resources |

Frequently Asked Questions about Humana Health Insurance in Alabama

1. How can I enroll in Humana Health Insurance Alabama?

If you want to enroll in Humana Health Insurance Alabama, you can visit their website or contact a licensed insurance agent for help with selecting a plan that meets your needs.

2. What types of plans does Humana offer in Alabama?

Humana offers individual, family, and Medicare Advantage plans in Alabama, each with different coverage options and benefits.

3. Are pre-existing conditions covered under Humana Health Insurance Alabama?

Humana Health Insurance Alabama provides coverage for pre-existing conditions, but limitations may apply depending on the specific plan you choose.

4. Does Humana Health Insurance Alabama offer dental and vision coverage?

Some Humana plans in Alabama may include dental and vision coverage as part of their benefits, while others may offer these services as optional add-ons.

5. Can I choose my doctor with Humana Health Insurance Alabama?

Humana has a network of healthcare providers in Alabama. While you may have the flexibility to choose your doctor within the network, out-of-network providers may require additional out-of-pocket costs.

6. Are prescription medications covered under Humana Health Insurance Alabama?

Most Humana plans in Alabama include coverage for prescription medications, but you may need to check the specific formulary to ensure your medications are covered.

7. What should I do if I have a claim dispute with Humana Health Insurance Alabama?

If you have a claim dispute with Humana Health Insurance Alabama, you can contact their customer service department to file a complaint and request a review of your claim.

8. Does Humana Health Insurance Alabama offer telehealth services?

Humana may offer telehealth services in Alabama, allowing members to consult with healthcare providers remotely for certain medical conditions or concerns.

9. How can I find out if my preferred hospital is in the Humana network in Alabama?

You can contact Humana Health Insurance Alabama or check their provider directory to see if your preferred hospital is part of their network of healthcare facilities.

10. Can I change my Humana Health Insurance Alabama plan during the year?

Changes to your Humana Health Insurance Alabama plan may be possible during certain qualifying events or enrollment periods, so it’s essential to check with the company or a licensed insurance agent for guidance on plan changes.

11. Are preventive care services covered under Humana Health Insurance Alabama?

Humana often includes coverage for preventive care services, such as wellness visits, screenings, and vaccinations, to help members stay healthy and catch health concerns early.

12. Is Humana Health Insurance Alabama accepted by most healthcare providers?

Most healthcare providers in Alabama accept Humana Health Insurance, but it’s essential to check with your provider before seeking care to ensure they are part of the Humana network.

13. How can I get more information about Humana Health Insurance Alabama plans and coverage options?

You can visit the Humana website, contact their customer service department, or speak with a licensed insurance agent to get more information about Humana Health Insurance Alabama plans and coverage options.

Conclusion

Despite some weaknesses, Humana Health Insurance Alabama offers comprehensive coverage, a strong provider network, and affordable options for individuals and families in the state. By understanding the strengths and weaknesses of Humana, you can make an informed decision about your health insurance needs and choose a plan that meets your requirements.

Remember to carefully review your options, compare plans, and consider your budget and healthcare needs when selecting a health insurance provider. With the right coverage from Humana Health Insurance Alabama, you can have Peace of mind knowing that you have access to quality healthcare services when you need them most.

Please take the time to explore Humana’s offerings, reach out to their customer service team with any questions or concerns, and start taking care of your health and well-being with reliable insurance coverage from Humana Health Insurance Alabama.

Don’t wait until you need medical care to think about health insurance. You can act now to protect yourself and your loved ones with a trusted insurance provider like Humana. Your health and Peace of mind are worth it.

Choose to prioritize your health and take the necessary steps to secure the coverage you need. With Humana Health Insurance Alabama, you can have confidence in your healthcare decisions and focus on staying healthy and happy for years to come.

Remember, your health is your most valuable asset – don’t wait until it’s too late to protect it with the right insurance coverage. Choose Humana Health Insurance Alabama for Peace of mind and reliable coverage you can count on when you need it most.

Disclaimer

The information I’ve included in this article is for informational purposes only and should not be considered medical or financial advice. It is essential for you to consult with a licensed insurance agent or healthcare provider to figure out the best health insurance options for your individual needs and circumstances. Any decisions regarding health insurance coverage should be made carefully and with the guidance of professionals in the field. I just wanted to let you know that the content in this article does not constitute endorsement or recommendation of any specific insurance provider or plan.