dental insurance tn

advertising

Introduction

Ensuring good oral health is essential for overall well-being. Dental insurance is a crucial aspect of maintaining oral health, providing coverage for various dental procedures and treatments. In Tennessee, dental insurance plays a significant role in helping individuals access affordable dental care services.

Dental insurance in Tennessee offers individuals the opportunity to receive preventive care, such as regular cleanings and check-ups, at a reduced cost or sometimes even for free. This proactive approach to dental health can help prevent more serious oral health issues from developing in the future.

However, it is important to understand the strengths and weaknesses of dental insurance in Tennessee to make an informed decision about the best coverage options available. This article will delve into the details of dental insurance in Tennessee, outlining its benefits and potential shortcomings.

Strengths of Dental Insurance in Tennessee

1. Affordable Care: Dental insurance plans in Tennessee often offer affordable premiums, making it accessible to a wide range of individuals. This affordability encourages people to prioritize their oral health and seek regular dental check-ups.

2. Comprehensive Coverage: Dental insurance in Tennessee typically covers a wide range of dental procedures, including routine cleanings, fillings, extractions, and more complex treatments such as root canals or crowns. This comprehensive coverage ensures that individuals can access the care they need without worrying about prohibitive costs.

3. Network of Providers: Most dental insurance plans in Tennessee have a network of providers, including dentists, oral surgeons, and orthodontists, who have agreed to provide services at a discounted rate. This network makes it easy for individuals to find a qualified dental provider in their area.

4. Preventive Care Emphasis: Dental insurance plans in Tennessee often prioritize preventive care, encouraging individuals to maintain good oral hygiene habits and seek regular dental check-ups. This focus on prevention can help reduce the likelihood of developing more serious dental issues in the future.

5. Flexibility in Coverage Options: Dental insurance plans in Tennessee offer a variety of coverage options to meet the diverse needs of individuals and families. Whether someone is looking for basic coverage for preventive care or more extensive coverage for complex treatments, there is a plan available to suit their needs.

6. Policy Add-Ons: Some dental insurance plans in Tennessee allow individuals to add on additional coverage for specific dental procedures or treatments at an extra cost. This flexibility enables individuals to customize their coverage to meet their unique oral health needs.

7. Tax Benefits: In some cases, dental insurance premiums may be tax-deductible, providing individuals with additional financial incentives to invest in dental insurance coverage. This tax benefit can help offset the cost of premiums and make dental insurance more affordable for individuals and families.

Weaknesses of Dental Insurance in Tennessee

1. Coverage Limitations: Dental insurance plans in Tennessee may have limitations on coverage for certain procedures or treatments, such as cosmetic dentistry or orthodontics. Individuals may need to pay out-of-pocket for these services, even if they have insurance coverage.

2. Waiting Periods: Some dental insurance plans in Tennessee have waiting periods before certain treatments are covered, particularly for more complex procedures. This waiting period can be a disadvantage for individuals who require immediate dental care.

3. High Deductibles: Dental insurance plans in Tennessee may have high deductibles that individuals must meet before coverage kicks in. These deductibles can be costly and pose a financial barrier to accessing necessary dental care.

4. Limited Provider Choices: While dental insurance plans in Tennessee have a network of providers, individuals may find that their preferred dentist is not within the network. This limitation can restrict individuals’ choices and may require them to switch to a different provider.

5. Pre-Existing Condition Exclusions: Some dental insurance plans in Tennessee may exclude coverage for pre-existing dental conditions, requiring individuals to pay for treatment out-of-pocket. This exclusion can be a drawback for individuals with ongoing dental issues.

6. Coordination with Medical Insurance: Dental insurance in Tennessee may not always coordinate seamlessly with medical insurance plans, leading to confusion or gaps in coverage for certain treatments that straddle the line between dental and medical care.

7. Annual Maximums: Some dental insurance plans in Tennessee have annual maximums on coverage, limiting the amount of benefits individuals can receive each year. This cap on benefits can be a disadvantage for individuals requiring extensive dental treatment.

Dental Insurance in Tennessee – Key Details

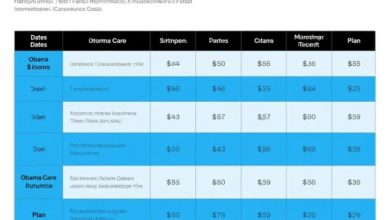

| Plan Type | Key Features | Cost |

|---|---|---|

| Preferred Provider Organization (PPO) | Wide provider network, low out-of-pocket costs | Varies depending on coverage level |

| Health Maintenance Organization (HMO) | Fixed monthly premiums, limited provider choices | Affordable for basic coverage |

| Indemnity Plan | Flexibility to choose any provider, higher out-of-pocket costs | Higher premiums for more comprehensive coverage |

Frequently Asked Questions (FAQs) about Dental Insurance in Tennessee

1. What is the cost of dental insurance in Tennessee?

The cost of dental insurance in Tennessee varies depending on the type of plan and coverage level you choose. Generally, premiums can range from affordable for basic coverage to higher for more comprehensive plans.

2. Does dental insurance in Tennessee cover major procedures like root canals?

Most dental insurance plans in Tennessee do cover major procedures such as root canals, but the extent of coverage may vary. I think it’s important to look over your plan details to understand what is covered.

3. Are there waiting periods for dental insurance coverage in Tennessee?

Some dental insurance plans in Tennessee do have waiting periods before certain treatments are covered. This waiting period can range from a few months to a year, depending on the plan.

4. Can I choose my dentist with dental insurance in Tennessee?

While dental insurance plans in Tennessee have provider networks, some plans allow you to choose any dentist, even if they are out of network. However, staying in-network may result in lower out-of-pocket costs.

5. What is the difference between PPO and HMO dental insurance plans in Tennessee?

A PPO plan in Tennessee offers a wide provider network and lower out-of-pocket costs, while an HMO plan has fixed monthly premiums but limited provider choices. The right plan for you will depend on your preferences and budget.

6. Are there any tax benefits to having dental insurance in Tennessee?

In some cases, dental insurance premiums in Tennessee may be tax-deductible, providing individuals with additional financial incentives to invest in coverage. You can consult with a tax professional to understand the specific tax benefits available to you.

7. What happens if I exceed the annual maximum on my dental insurance plan in Tennessee?

If you exceed the annual maximum on your dental insurance plan in Tennessee, you may need to pay out-of-pocket for any additional dental care expenses. It’s important to be aware of your plan’s limits and manage your dental care accordingly.

Conclusion

Overall, dental insurance in Tennessee offers numerous benefits, including affordable care, comprehensive coverage options, and a focus on preventive care. While there are some weaknesses to consider, such as coverage limitations and high deductibles, the advantages of dental insurance outweigh the drawbacks.

For individuals seeking to prioritize their oral health and access quality dental care services, investing in dental insurance in Tennessee is a wise decision. By understanding the key details and weighing the pros and cons of different plans, individuals can choose a dental insurance option that meets their needs and budget.

Please take action today to protect your oral health and make sure you can access essential dental treatments by exploring dental insurance options in Tennessee. With the right coverage in place, you can enjoy Peace of mind knowing that your oral health needs are covered.

Don’t wait until dental issues arise – be proactive about your oral health and invest in dental insurance in Tennessee today. Your smile and overall well-being will thank you for making oral health a priority.

Thank you for taking the time to learn more about dental insurance in Tennessee and the importance of maintaining good oral health. Choose to prioritize your dental care and enjoy the benefits of having coverage that supports your oral health needs.

Disclaimer

The information in this article is for general informational purposes only and should not be considered legal or financial advice. I think it’s important to consult with a qualified professional to discuss your specific dental insurance needs and options in Tennessee. The details and coverage options for dental insurance in Tennessee may vary, so it is essential to review plan details carefully before making a decision. Always consider your circumstances and budget when selecting a dental insurance plan in Tennessee.