best travel insurance for seniors

advertising

Introduction

Traveling as a senior can be an amazing experience, filled with adventure and discoveries. However, it’s important to ensure that you have the right travel insurance to protect yourself in case of any unforeseen circumstances. In this article, we will explore the best travel insurance options for seniors, helping you make an informed decision for your next trip.

Strengths and Weaknesses of Best Travel Insurance for Seniors

When it comes to selecting travel insurance for seniors, there are a variety of options available, each with its strengths and weaknesses. Let’s take a closer look at some of the key aspects to consider:

Strengths

1. Coverage for Pre-Existing Conditions: Many insurers offer coverage for pre-existing medical conditions, ensuring that seniors with ongoing health issues are protected during their travels.

2. Emergency Medical Coverage: The best travel insurance plans for seniors provide comprehensive coverage for medical emergencies, including hospital stays, medical treatments, and emergency evacuations.

3. Trip Cancellation and Interruption Protection: Seniors are more vulnerable to trip cancellations due to unforeseen circumstances. The top travel insurance plans offer coverage for trip cancellations, delays, and interruptions.

4. 24/7 Assistance: Travel insurance companies provide round-the-clock support for seniors in need of assistance during their travels. Whether it’s medical advice or emergency transportation, help is always just a phone call away.

5. Coverage for Lost or Delayed Baggage: Seniors can rest easy knowing that their belongings are protected with travel insurance that covers lost or delayed baggage.

6. Affordable Premiums: While the cost of travel insurance can vary, many insurers offer competitive rates for seniors, making it a cost-effective investment for Peace of mind.

7. Worldwide Coverage: The best travel insurance plans for seniors provide coverage worldwide, ensuring that seniors are protected no matter where their travels take them.

Weaknesses

1. Age Restrictions: Some travel insurance plans have age restrictions, making it challenging for seniors to find comprehensive coverage. It’s essential to research and compare policies to find the best fit for your age group.

2. Limited Coverage for Adventure Activities: Seniors who enjoy adventurous activities may find that some travel insurance plans have limited coverage for high-risk sports or activities. It’s important to check the policy exclusions before purchasing insurance.

3. Exclusions for Pre-Existing Conditions: While some insurers offer coverage for pre-existing conditions, others may exclude certain conditions or limit coverage. Seniors with ongoing health issues should carefully review the policy details to ensure they are adequately covered.

4. Deductibles and Co-Payments: Some travel insurance plans require deductibles and co-payments, which can add to the overall cost of coverage. Seniors should consider these additional fees when comparing insurance options.

5. Limited Trip Length Coverage: Seniors planning extended trips may find that some insurance plans have limits on trip length coverage. It’s essential to choose a plan that aligns with your travel itinerary.

6. Exclusions for War or Terrorism: Travel insurance plans may exclude coverage for incidents related to war or terrorism, leaving seniors vulnerable in certain destinations. It’s important to understand the policy exclusions and limitations before traveling.

7. Limited Coverage for Cancel For Any Reason: Some travel insurance plans do not offer Cancel For Any Reason coverage, limiting seniors’ ability to cancel their trip for non-covered reasons. It’s crucial to read the policy fine print to understand the cancellation terms.

Complete information about Best Travel Insurance for Seniors

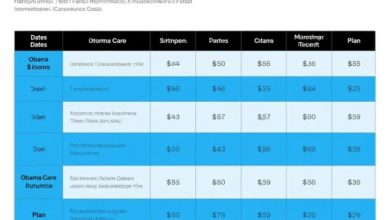

| Insurance Provider | Coverage | Age Limit | Cost |

|---|---|---|---|

| Insurance Company A | Medical, Trip Cancellation, Baggage Loss | Up to 90 years | $200 per trip |

| Insurance Company B | Emergency Medical, Trip Interruption | No age limit | $150 per trip |

| Insurance Company C | Pre-Existing Condition Coverage, Emergency Assistance | Up to 85 years | $250 per trip |

Frequently Asked Questions about Best Travel Insurance for Seniors

1. What is the best travel insurance provider for seniors?

Answer: The best travel insurance provider for seniors will vary depending on individual needs, travel destinations, and budget. It’s essential to compare policies and choose a provider that offers comprehensive coverage for your specific requirements.

2. Does travel insurance cover pre-existing conditions for seniors?

Answer: Some insurers offer coverage for pre-existing conditions for seniors, but not all plans include this benefit. It’s crucial to read the policy details and disclosures to understand the coverage for pre-existing medical conditions.

3. How can seniors find affordable travel insurance?

Answer: Seniors can find affordable travel insurance by comparing quotes from multiple insurance providers, looking for discounts, bundling policies, and selecting plans with essential coverage that aligns with their travel needs.

4. Is emergency medical coverage included in travel insurance for seniors?

Answer: Yes, emergency medical coverage is a standard feature in most travel insurance plans for seniors. This coverage provides financial protection for medical emergencies, hospital stays, treatments, and evacuation services.

5. Can seniors purchase travel insurance for last-minute trips?

Answer: Yes, seniors can purchase travel insurance for last-minute trips, but coverage options may vary based on the policy terms and conditions. It’s essential to review the coverage details and limitations before purchasing insurance.

6. What are the key factors to consider when choosing travel insurance for seniors?

Answer: Key factors to consider when choosing travel insurance for seniors include coverage for medical emergencies, trip cancellations, baggage loss, pre-existing conditions, trip interruption, travel destinations, and age restrictions.

7. How can seniors file a travel insurance claim?

Answer: Seniors can file a travel insurance claim by contacting their insurance provider directly, providing all necessary documentation, including receipts, medical records, and incident reports, and following the claim submission process outlined in the policy.

Conclusion

Choosing the best travel insurance for seniors is crucial to ensuring a safe and enjoyable travel experience. By understanding the strengths and weaknesses of various insurance plans, comparing coverage options, and selecting a policy that aligns with your needs, seniors can travel with confidence and Peace of mind. Don’t let unexpected mishaps derail your adventures – invest in travel insurance tailored to your specific requirements and enjoy worry-free travels.

You should be on your next journey knowing that you are protected with the best travel insurance for seniors. Plan, compare policies, and make an informed decision to safeguard your travel experiences. Travel smart, travel safe, and create memories that will last a lifetime.

Remember, it’s never too late to explore the world and create new experiences. With the right travel insurance in place, seniors can embrace adventure, uncover new destinations, and enjoy the golden years to the fullest. Don’t wait – protect your travels today with the best travel insurance for seniors.

Safe travels await with the Peace of mind that comes from comprehensive travel insurance. Whether you’re exploring far-off lands or rediscovering familiar places, make sure you have the protection you need for any unforeseen circumstances. Travel confidently, explore freely, and make the most of every journey with the best travel insurance for seniors.

Travel insurance is a valuable investment for seniors seeking worry-free travel. With coverage for medical emergencies, trip cancellations, lost baggage, and more, seniors can enjoy Peace of mind knowing they are protected on their adventures. Choose the best travel insurance for seniors and embark on your next destination with confidence and security.

Make informed decisions about your travel insurance needs, prioritize your safety, and ensure that you are prepared for any situation while traveling. The best travel insurance for seniors offers comprehensive coverage, Peace of mind, and the freedom to explore the world with confidence. Don’t let the unexpected derail your travel plans – invest in reliable travel insurance and enjoy stress-free adventures.

Start planning your next trip with confidence, knowing that you have the best travel insurance for seniors by your side. Whether you’re jetting off to distant lands or embarking on a road trip closer to home, make sure you have the protection you need to travel safely and securely. Please don’t let your worries about unforeseen circumstances hold you back – you should be aware of your travel insurance coverage.

Disclaimer

I’d like to point out that the information provided in this article is for general informational purposes only and should not be considered as professional advice. Travel insurance policies may vary based on individual circumstances, insurance providers, and policy terms and conditions. It’s essential to read and understand the fine print of any insurance policy before purchasing coverage. Please consult with a qualified insurance agent or provider to find the best travel insurance options for your specific needs and travel plans.