life insurance with no medical exam

advertising

The Value of Life Insurance with No Medical Exam

In today’s fast-paced world, life insurance has become a crucial part of financial planning. One common concern that many individuals have when considering life insurance is the medical exam requirement. However, there are options available that provide coverage without the need for a medical examination. Understanding the benefits of life insurance with no medical exam is essential for making informed decisions about your financial future.

Strengths of Life Insurance with No Medical Exam

One of the primary strengths of life insurance with no medical exam is the convenience it offers. Traditional life insurance policies often require applicants to undergo rigorous medical examinations, which can be time-consuming and invasive. With a policy that does not require a medical exam, you can secure coverage quickly and easily, without the hassle of scheduling appointments and waiting for test results.

Another advantage of life insurance with no medical exam is the accessibility it provides to individuals with pre-existing health conditions. For those who may have difficulty obtaining coverage due to health issues or disabilities, a policy that does not require a medical exam can be a lifeline. This type of insurance ensures that individuals with health concerns can still secure the protection they need to safeguard their loved ones.

Additionally, life insurance without a medical exam typically offers simplified underwriting processes. This means that the application process is much quicker and more straightforward than traditional policies that involve extensive medical assessments. As a result, you can get the coverage you need without the stress and uncertainty of complicated underwriting procedures.

Furthermore, life insurance with no medical exam often provides competitive premiums and options for coverage amounts. This type of policy is designed to be accessible and affordable, making it an attractive choice for individuals looking to protect their families and assets without breaking the bank. With a variety of coverage options available, you can select a policy that fits your needs and budget.

Another strength of life insurance with no medical exam is the flexibility it offers in terms of policy issuance. Traditional life insurance policies can take weeks or even months to be approved and issued, given the extensive medical evaluations and underwriting processes involved. In contrast, policies that do not require a medical exam can often be approved and activated within days, providing immediate Peace of mind and protection for you and your loved ones.

Moreover, life insurance with no medical exam may offer higher coverage limits than traditional policies. While the exact coverage amounts available will depend on the insurance provider and policy type, many no-exam options provide substantial coverage that can help secure your family’s financial future in the event of your passing. With higher coverage limits, you can rest assured that your loved ones will have the resources they need to cover expenses and maintain their lifestyle.

Finally, life insurance with no medical exam is an excellent option for individuals who prioritize privacy and discretion in their financial affairs. Traditional life insurance applications often require detailed medical histories and may involve sharing sensitive personal information with multiple parties. By opting for a policy that does not require a medical exam, you can maintain your privacy and confidentiality while still obtaining essential coverage for your loved ones.

Weaknesses of Life Insurance with No Medical Exam

While life insurance with no medical exam offers numerous benefits, it is essential to consider the potential drawbacks before making a decision. One of the weaknesses of this type of insurance is the limited coverage options available compared to traditional policies. No-exam policies may have restrictions on coverage amounts or additional riders that can be included, limiting the customization options for policyholders.

Another weakness of life insurance with no medical exam is the potential for higher premiums compared to policies that require medical evaluations. Since insurance providers do not have the benefit of detailed medical information to assess risk, they may charge higher rates to offset the potential unknown health conditions of policyholders. This can result in higher monthly premiums and increased costs over the life of the policy.

Additionally, life insurance without a medical exam may have stricter eligibility criteria than traditional policies. While these types of policies are designed to be more accessible, they may still have age restrictions, health limitations, or coverage exclusions that could affect your ability to qualify for coverage. Understanding the eligibility requirements for no-exam policies is essential for ensuring that you can secure the protection you need.

Another weakness of life insurance with no medical exam is the possibility of limited death benefits or payout options. Since these policies typically have simplified underwriting processes, they may not provide the same level of coverage or flexibility as traditional policies with extensive medical evaluations. It is essential to carefully review the terms and conditions of a no-exam policy to make sure that it meets your financial goals and provides adequate protection for your beneficiaries.

Furthermore, life insurance with no medical exam may have restrictions on policy renewals or conversions to permanent coverage. Some policies may have limited renewal options or conversion privileges, which can impact your ability to adjust coverage as your needs change over time. It is crucial to understand the terms of your policy and any limitations on renewals or conversions to avoid potential gaps in coverage or loss of benefits in the future.

Moreover, life insurance without a medical exam may have exclusions for certain pre-existing health conditions or lifestyle factors that could impact coverage eligibility. While these policies are designed to be more accessible, they may still have limitations on coverage for specific health conditions, occupations, or activities. It is essential to look over the policy exclusions carefully and disclose any relevant information to make sure that you are fully covered in case of a claim.

Finally, life insurance with no medical exam may have limitations on beneficiaries or payout structures that can affect your estate planning goals. Some policies may have restrictions on beneficiary designations or payout options, which could impact how your policy benefits are distributed after your passing. I want you to know that understanding the terms and conditions of your policy is essential for ensuring that your wishes are carried out and that your loved ones receive the financial support they need.

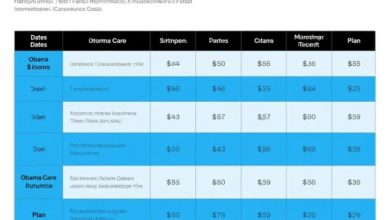

Life Insurance with No Medical Exam Table

Below is a table containing important information about life insurance with no medical exam:

| Insurance Provider | Coverage Amounts | Premiums | Eligibility Criteria | Renewal Options |

|---|---|---|---|---|

| Company A | $50,000 – $250,000 | Starting at $20 per month | Ages 18-65, non-smokers preferred | Renewable every 10 years |

| Company B | $100,000 – $500,000 | Starting at $30 per month | Ages 25-70, no major health issues | Convertible to permanent policy |

| Company C | $75,000 – $300,000 | Starting at $25 per month | Ages 21-60, no tobacco use | Guaranteed renewal every 5 years |

Frequently Asked Questions about Life Insurance with No Medical Exam

1. What is life insurance with no medical exam?

Life insurance with no medical exam is a type of insurance policy that does not require applicants to undergo a medical examination as part of the underwriting process. This type of policy typically offers simplified underwriting and faster approval times.

2. Are there age restrictions for life insurance with no medical exam?

While age restrictions may vary depending on the insurance provider, most policies have age limits for applicants to qualify for coverage. It is essential to have a look at the eligibility criteria of each policy to see if you meet the age requirements.

3. Can I get high coverage amounts with no-exam life insurance?

Yes, some insurance providers offer high coverage limits for policies that do not require a medical exam. However, the exact coverage amounts available will depend on the provider and policy type, so it is essential to compare options to find the best fit for your needs.

4. Do I need to disclose my health history for no-exam life insurance?

While policies that do not require a medical exam typically have simplified underwriting processes, it is still essential to disclose any relevant health information on your application. Failing to provide accurate information could result in coverage denial or claim disputes in the future.

5. Can I convert a no-exam policy to permanent coverage?

Some insurance providers offer conversion options for policies that do not require a medical exam. This allows policyholders to convert their term coverage to a permanent policy without the need for additional medical evaluations. Check with your insurance provider for conversion details.

6. What happens if I need to increase my coverage amounts?

If you need to increase your coverage amounts for a policy that does not require a medical exam, you may need to apply for additional coverage or purchase a new policy. It is essential to have a look at your options with your insurance provider to make sure that your coverage meets your current needs.

7. Are there any exclusions for pre-existing conditions with no-exam life insurance?

While some policies may have exclusions for pre-existing health conditions, coverage options for policies that do not require a medical exam can vary. You need to look over the terms and conditions of your policy to understand any exclusions or limitations that may apply to your coverage.

Encouraging Action for Financial Security

As you explore the benefits and considerations of life insurance with no medical exam, it is essential to take proactive steps towards securing your financial future. By understanding the strengths and weaknesses of these types of policies, you can make informed decisions that align with your financial goals and your family’s needs.

Remember that life insurance is a crucial component of financial planning, providing Peace of mind and protection for your loved ones in the event of your passing. By exploring options for coverage without a medical exam, you can streamline the application process, secure competitive premiums, and tailor your policy to fit your specific needs.

When considering life insurance with no medical exam, be sure to compare options from reputable providers, review eligibility criteria, and carefully assess coverage amounts and policy terms. By doing so, you can select a policy that offers the protection and flexibility you need to safeguard your family’s financial well-being.

Ultimately, the decision to invest in life insurance with no medical exam is a proactive step towards financial security and Peace of mind. Protecting your loved ones and assets is a priority, and having the right coverage in place can provide reassurance that your financial legacy will be preserved for generations to come.

Please take the time to explore your options, ask questions, and seek guidance from insurance professionals to make the best choices for your unique circumstances. With a well-informed approach to life insurance, you can create a solid foundation for your financial future and ensure that your loved ones are protected no matter what the future holds.

Remember that life insurance is not just a financial product – it is a symbol of love, responsibility, and foresight. By taking steps to secure your family’s economic well-being, you are investing in their future and providing them with the security and stability they deserve. Act now to protect what matters most and secure a brighter tomorrow for you and your loved ones.

Decide to prioritize financial security and Peace of mind today by exploring the benefits of life insurance with no medical exam. Your family’s future is worth protecting, and with the right coverage in place, you can rest assured that they will be supported and cared for no matter what life may bring. Take action now to secure the financial legacy you want to leave behind and ensure that your loved ones are taken care of for years to come.

Invest in your family’s future and secure the financial protection they need with life insurance that offers Peace of mind without the need for a medical exam. By prioritizing proactive planning and thoughtful decision-making, you can create a lasting legacy of love and security for generations to come. Act now to safeguard your family’s future and enjoy the Peace of mind that comes with knowing they are protected and cared for, no matter what the future may hold.

Disclaimer

The information provided in this article is for general informational purposes only and should not be considered legal, financial, or medical advice. It is essential to consult with qualified professionals before making any decisions related to life insurance or financial planning. The content of this article is based on current practices and industry standards and may be subject to change. While every effort has been made to ensure the accuracy of the information presented, no guarantees are made regarding the completeness or reliability of the content. I would recommend that readers conduct their research and seek guidance from trusted sources before taking any action based on the information provided.