why life insurance

advertising

Introduction

In today’s uncertain world, having life insurance is more important than ever. Life insurance provides financial protection for your loved ones in the event of your unexpected death. It can help cover funeral expenses, pay off debts, and ensure that your family can maintain their standard of living. In this article, we will delve into the reasons why life insurance is a crucial investment for your future.

Strengths of Life Insurance

One of the key strengths of life insurance is the Peace of mind it provides. Knowing that your family will be taken care of financially can alleviate a significant amount of stress. Life insurance can also act as income replacement, ensuring that your loved ones can continue to meet their financial obligations. Additionally, life insurance can help cover estate taxes and other expenses, ensuring that your assets are passed on smoothly to your beneficiaries.

Peace of Mind

Imagine not having to worry about how your family will cope financially after your passing. Life insurance can provide the Peace of mind that comes with knowing your loved ones will be financially secure.

Income Replacement

If you are the primary breadwinner in your family, life insurance can provide essential income replacement. This can help your family continue to pay bills, mortgages, and other living expenses.

Estate Tax Coverage

Life insurance can help cover estate taxes, ensuring that your beneficiaries receive the full value of your estate without having to sell off assets.

Debt Repayment

Life insurance can also be used to pay off debts, ensuring that your family is not burdened with financial obligations after your passing.

Final Expenses

Funeral expenses can add up quickly. Life insurance can help cover these costs, so your family does not have to worry about the financial burden.

Security for Children’s Education

Planning for your children’s education is crucial. Life insurance can provide a financial safety net to ensure that your children’s educational expenses are taken care of.

Flexibility of Use

Life insurance provides flexibility in how the funds can be used. Your beneficiaries can use the proceeds for various purposes, such as paying off debts, covering living expenses, or investing for the future.

Weaknesses of Life Insurance

While life insurance offers numerous benefits, there are also some potential drawbacks to consider. It is essential to weigh the strengths and weaknesses of life insurance before making a decision.

Cost

One of the main weaknesses of life insurance is the cost. Depending on the type of policy and coverage amount, premiums can be expensive, especially for individuals with pre-existing health conditions or older age.

Complexity of Policies

Life insurance policies can be complex, with various terms, conditions, and exclusions. It is crucial to thoroughly understand the terms of your policy to ensure that you are getting the coverage you need.

Risk of Lapse

If you are unable to pay your premiums, your life insurance policy may lapse, resulting in the loss of coverage. It is essential to review your policy regularly and ensure that you can afford the premiums.

Potential Investment Returns

Some types of life insurance policies offer investment components, but the returns may not be as high as other investment options. It is essential to consider the potential returns of your policy and compare them to other investment opportunities.

Policy Limitations

Life insurance policies may have limitations on coverage amounts, beneficiaries, and payout options. It is essential to have a look at the policy details to make sure that it meets your specific needs and goals.

Requirement for Medical Exam

Some life insurance policies require a medical exam to assess your health status. This can be invasive and may result in higher premiums for individuals with pre-existing health conditions.

Underwriting Process

The underwriting process for life insurance can be lengthy and thorough. Insurers may require medical records, financial information, and other documents to assess your risk. This process can delay the issuance of your policy.

The Benefits of Life Insurance in Detail

Life insurance offers numerous benefits that can provide financial security and Peace of mind for you and your loved ones. Let’s delve deeper into the advantages of life insurance and how it can benefit you:

Financial Security for Your Loved Ones

One of the primary benefits of life insurance is the financial security it provides for your loved ones. In the event of your unexpected death, life insurance can help cover funeral expenses, outstanding debts, and ongoing living expenses for your family.

Income Replacement

If you are the primary earner in your family, life insurance can act as income replacement. This ensures that your family can maintain their standard of living and meet their financial obligations, even without your income.

Debt Repayment

Life insurance can be used to pay off any outstanding debts, such as mortgages, student loans, or credit card balances. This can help prevent your family from inheriting financial burdens in the event of your passing.

Estate Taxes Coverage

Life insurance can help cover estate taxes, ensuring that your beneficiaries receive the full value of your estate without having to sell off assets. This can protect your legacy and ensure a smooth transfer of assets.

Education Fund for Children

Planning for your children’s education is essential. Life insurance can provide a financial safety net to ensure that your children’s educational expenses are taken care of, even if you are no longer there to provide for them.

Flexible Use of Funds

The funds from a life insurance policy can be used in various ways, depending on your family’s needs. Whether it’s covering living expenses, investing for the future, or paying off debts, life insurance provides flexibility in how the proceeds can be utilized.

Peace of Mind

Knowing that your loved ones will be taken care of financially after your passing can provide Peace of mind. Life insurance can alleviate the stress and worry associated with the uncertainty of the future and ensure that your family is protected.

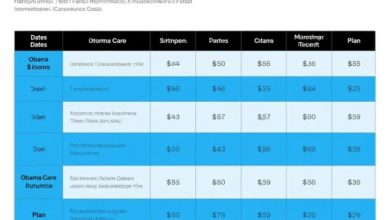

Table: Why Life Insurance

| Reasons | Benefits |

|---|---|

| Financial Security | Peace of mind, income replacement |

| Debt Repayment | Avoid financial burdens for the family |

| Estate Taxes Coverage | Ensure smooth transfer of assets |

| Education Fund | Financial security for children |

| Flexibility of Use | Various spending options for beneficiaries |

| Peace of Mind | Alleviate stress and worry |

Frequently Asked Questions about Life Insurance

What is life insurance?

Life insurance is a contract between an individual and an insurance company that provides a death benefit to the policyholder’s beneficiaries in exchange for premium payments.

How much life insurance do I need?

The amount of life insurance you need depends on various factors, such as your income, debts, and financial goals. It is essential to look over your financial situation to figure out the appropriate coverage amount.

What factors affect life insurance premiums?

Factors that can affect life insurance premiums include age, health status, occupation, lifestyle habits, and coverage amount. Insurers assess these factors to determine the risk of insuring an individual.

Can I change my life insurance policy?

Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage, adding riders, or changing beneficiaries. It is essential to have a look at your policy regularly to make sure it aligns with your current needs.

Is life insurance worth it?

Life insurance is worth it for many individuals, especially those with dependents or financial obligations. It provides economic security and Peace of mind for your loved ones in the event of your passing.

When is the best time to buy life insurance?

The best time to buy life insurance is when you are young and healthy, as premiums tend to be lower. However, it is never too late to purchase life insurance, as it can provide valuable protection at any stage of life.

How can I choose the right life insurance policy?

To choose the right life insurance policy, consider factors such as coverage amount, premium affordability, policy terms, and insurer reputation. It is essential to compare quotes from multiple insurers to find the best policy for your needs.

Conclusion

Life insurance is a crucial investment that provides financial security and Peace of mind for you and your loved ones. By understanding the strengths and weaknesses of life insurance, you can make an informed decision about your financial future. Please take action today to make sure that your family is safe in the event of the unexpected.

Remember, life insurance is not just about protecting your assets. It’s about safeguarding the financial well-being of your loved ones and providing them with a secure future. Don’t wait until it’s too late – invest in life insurance today for a brighter tomorrow.

You can consult with a financial advisor or insurance agent to find the right policy for your needs and budget. They can help you navigate the complexities of life insurance and ensure that you make a wise investment for your future.

Life insurance is a decision that can have a significant impact on your family’s financial security. Don’t delay – take the necessary steps to protect your loved ones and secure their future with a comprehensive life insurance policy.

Remember, Peace of mind is priceless. Take the first step towards financial security today by investing in life insurance. Your loved ones will thank you for the protection and security that life insurance provides.

Do not leave your family’s financial future to chance. Please make sure that they are taken care of in case you pass by, and secure a life insurance policy today. It’s a decision that will benefit you and your loved ones for years to come.

Life insurance is not just a financial investment – it’s a commitment to your family’s well-being and stability. Choose to protect your loved ones with life insurance and secure their future, no matter what life may bring.

Disclaimer

I want to let you know that the information provided in this article is for general informational purposes only and should not be considered legal or financial advice. Before purchasing a life insurance policy, it is recommended to consult with a licensed insurance professional to assess your individual needs and circumstances. The decision to buy life insurance should be made after careful consideration of your financial situation and goals.